Japan Active ESG

Japanese Stocks ESG1 Active Management

We are committed to ESG Investing and we carry out in-depth ESG analysis for Japanese stocks along with promoting a stewardship activity for the securities that we own. ESG investing involves the consideration of ESG factors in the investment process.

In our ESG investment approach, in addition to financial analysis and evaluation, we also evaluate the Sustainability performance of companies via analysis of ESG factors. In other words, our ESG investment approach is based on the idea that “companies that promote sustainable economic growth by fulfilling their social responsibilities are the ones that can be expected to grow most sustainably”. Therefore, we invest in companies that are still undervalued and expected to generate sustainable economic growth by fulfilling their social responsibilities.

All in all, when we select stocks and build portfolios, we combine our detailed financial analysis with considerations of a company’s ESG performance to ensure the companies we choose are positioned for secular growth and enable our portfolios to generate sustainable returns for our investors.

※1 ESG stands for Environmental, Social, and Governance

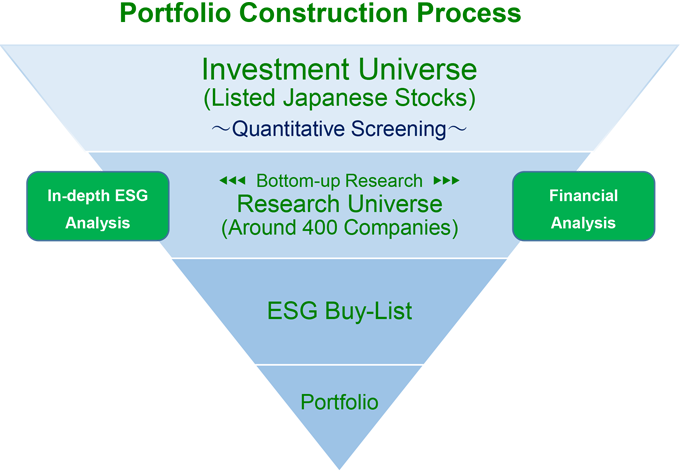

Portfolio Construction Process

Features of the ESG Investing

- Using a proprietarily established in-house research system for ESG assessment

- Evaluating companies’ ESG initiatives and measures, using our own criteria, based on our original questionnaires and individual interviews

- Performing financial analysis to determine fair stock price based on bottom-up research

- Aiming to achieve higher added value by combining ESG assessment and financial analysis

- Promoting stewardship activity via engagement with companies on their ESG performance so as to ensure good sustainability practices